The United States-Mexico remittance corridor is one of the largest in the world. During 2018, Mexico received over $35 billion in migrant remittance inflows. Most of these remittances are sent by electronic wire transfers, which represent about 96% of all remittances. The complexity behind the execution of these transactions can create high costs for money transmitters which turn directly into higher fees for clients.

Globally, the average cost of a 200-dollar remittance is 7%, but there is significant cost variance depending on the region where the remittance is being received. South Asia is the cheapest region for receiving money at 5.2%, while the most expensive region is Sub-Saharan Africa at 9%. Latin America stands as the second cheapest at 6.3%.

Technology can have a positive impact on the time and effort required to send and receive remittances. For Mexico specifically, it is estimated that digital remittances could save recipients approximately fifteen days over the course of their lives, nearly 100 million hours in aggregate for the economy and almost $450 million in economic value based on the average income of a Mexican citizen.

The latest World Bank Report from June 2019 shows that mobile money is the cheapest method for funding a remittance transaction at an average cost of 4.88%. This figure is relevant for two main reasons. First, the average cost of mobile money to fund a remittance transaction is closer to the United Nations sustainable development goal to reduce the global average cost of remittances services to less than 3% by 2030. Second,the average cost of a transaction funded by mobile money is more than two percentage points cheaper than transactions financed by a bank account (6.99%) or cash (6.97%).

Besides reducing the costs that Mexican families must accrue sending money across the border, mobile money is important because the vast majority of Mexicans operate without a bank account (56%) or access to financial services. The reason for this is that the majority of the population still considers the costs of financial services to be too high, or they live too far from a bank branch. This creates an economy where 90% of all transactions are still being carried out in cash. The digitization of money and financial services is a great way of incorporating people to the digital economy, allowing a reduction of costs and the need for cash.

Cryptocurrencies offer a great alternative for people who send and receive remittances since cryptocurrency networks charge meager transactional fees as compared with traditional wire transfers and cryptocurrencies can allow transactions to be completed in a matter of minutes instead of days. When a Mexican uses a remittance company that is powered by cryptocurrency technology, they can save between 2.83% and 5.62% for a 300-dollar remittance. By using cryptocurrencies, costs may decrease between 50% and 90% compared with traditional methods.

By partnering with companies in the United States, Bitso has been able to deliver remittances to Mexican families since 2015, which has added up to a significant impact in the savings of families. According to our estimates, if all remittances sent to Mexico were cryptocurrencies, Mexican families could save an average of $1.6 billion per year. Data shows that most Mexican families use remittance funds to cover basic needs such as food, health, and education.

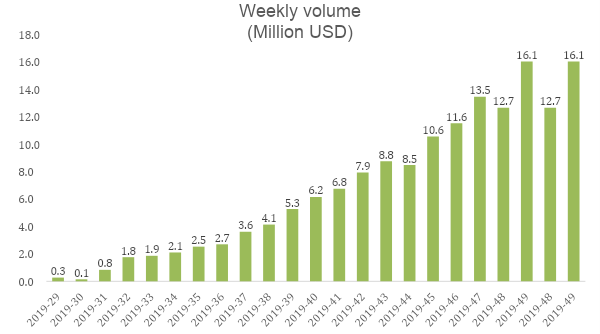

In the last couple of months, Bitso has seen exponential growth in the volume of remittances sent from the United States to Mexico. By leveraging the technology of a cryptocurrency exchange, Bitso is able to provide other financial institutions with on-demand liquidity for global payments. This allows transactions to be sent in less than 90 seconds, which is profoundly less time that the 3 to 5 days it takes using traditional methods.

Data released by the Mexican Central Bank shows that from January to August 2019, $23.8 billion have been sent to Mexico from the U.S., which would make for an average of $682 million being sent every week. The volume that Bitso is currently operating for cross-border transactions has been steadily growing for the last few months. We believe it will continue to grow as usage of our remittance infrastructure increases and continues reducing transaction costs for our clients. The following graph shows the volume of the leading institutional money transmitters using Bitso.

Bitso’s new remittances product has been officially operating for four months. The way the product works is the following: a money transmitter receives the money as it would traditionally but converts it into crypto at a crypto exchange in the US, afterwards it is sent to Bitso and converted to Mexican pesos. It is a fairly straightforward process, and as mentioned earlier it can be done at a fraction of the cost and time.

Currently, with the new product Bitso processes around 2.5% of all US remittances sent to Mexico and this percentage is on target to grow 15% per week. By the end of 2020, Bitso has the objective of sending and receiving 20% of the weekly remittances through cryptocurrencies, while expanding on its potential to provide cost-effective and fast services for the domestic market.

Bitso plans to keep developing and pushing the adoption of this technology with the objective of improving people’s lives. We believe governments around the world should foster innovative environments for these types of technologies to exist.

Emilio Rivero Coello is Senior Strategy Analyst at Bitso, a leading Mexican cryptocurrency exchange.