Some facts about digital currency and terrorist financing

After the recent attacks in Paris, governments are redoubling their efforts to combat terrorist financing, and we’ve been asked how digital currencies might be affected by these efforts.

After the recent attacks in Paris, governments are redoubling their efforts to combat terrorist financing, and we’ve been asked how digital currencies might be affected by these efforts.

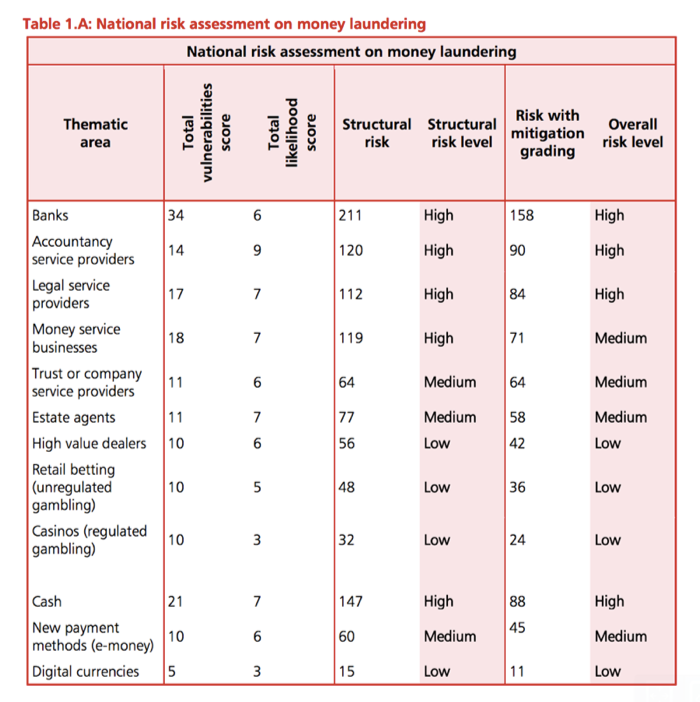

After the recent attacks in Paris, governments are redoubling their efforts to combat terrorist financing, and we’ve been asked how digital currencies might be affected by these efforts. The answer is that digital currencies like Bitcoin, and the service providers that help consumers access digital currency networks, don’t pose any greater threat of being abused by criminals and terrorists than other financial networks. Yet that doesn’t stop the publication of headlines like, “After Paris Attacks, Europe Is Cracking Down On Bitcoin.”

Here are some facts on what governments are thinking about digital currency:

The fact is that regulators understand that digital currencies do not pose the greatest risk for terrorist financing, and to the extent digital currencies pose some risk, a “crack down” on their use would likely only serve to drive out legitimate players, which in turn would only serve to limit governments’ visibility into illicit uses. Overreaction by jittery policymakers in the wake of a crisis is always a concern, which is why education before such crises is so important. We’ve been engaged in just such education for over a year, and we’re hopeful policymakers understand that an overreaction would be counterproductive, whatever the headlines may say.